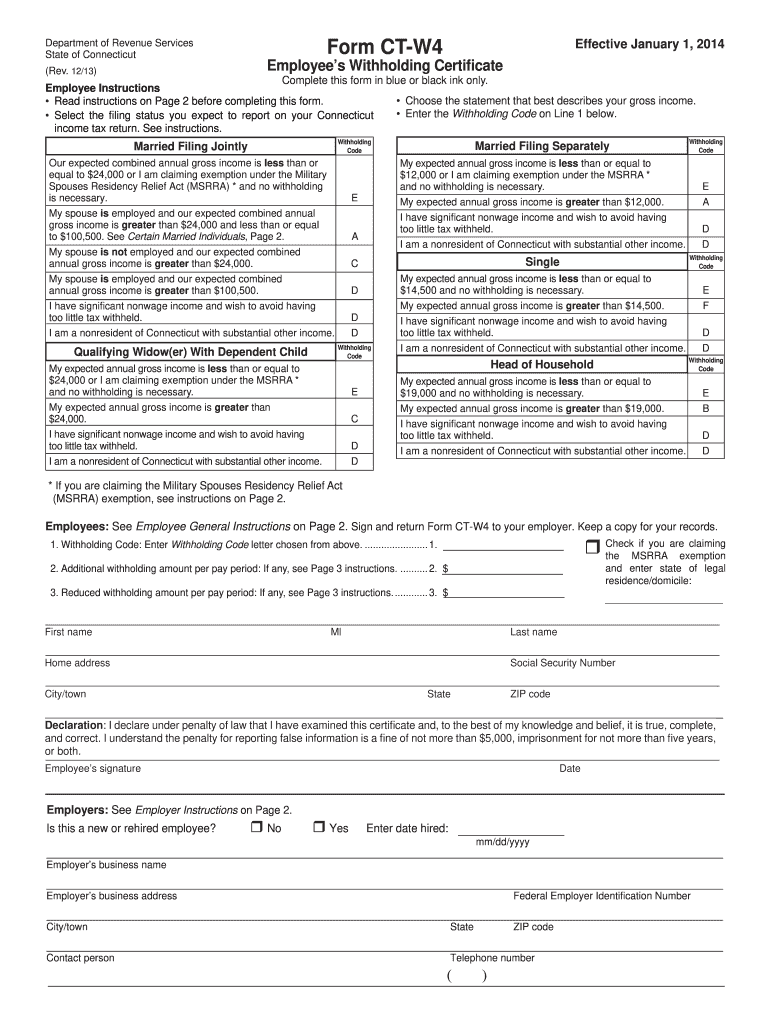

Who needs Form CT-W4?

Form CT-W4 should be filed by employees working in the State of Connecticut. Form CT-W4 or, as it is called, the Employee's Withholding Certificate, is to be filed with the employer either right after employment process or when any changes in the employee's filing status occur.

What is Form CT-W4 for?

Form CT-W4 serves to provide the employer with accurate information about an employee's income and all the factors that influence it. Every time an employee's tax situation changes, she should claim withholding allowances that define the amount of tax to be withheld from employee's annual income.

Is Form CT-W4 accompanied by other forms?

In general, the CT-W4 form is an independent document that doesn't require any attachments. However, depending on the kind of exemptions the filer is going to claim, some other forms should accompany form CT-W4. For example, armed forces personnel should provide copies of the corresponding statements or acts alongside form CT-W4. You may look through the full list of additional documents on the second page of the form CT-W4.

When is Form CT-W4 due?

Form CT-W4 should be completed at least once a year. Usually, the CT-W4 form is filed every time the employee's tax status changes.

How do I fill out Form CT-W4?

Form CT-W4 is a four-page document. The first page contains brief instructions and a list of statements that describe the employee's gross income. Under the statements, there are three fields for the employee to complete. There, an employee must enter:

- The code of the corresponding statement

- Additional withholding amount

- Reduced withholding amount (see the information for these fields on page 3 of the CT-W4 form.)

After the fields there are boxes to be filled out with the employee’s name and contact information and employer's business name, Federal identification number, and address. For more details, read the instructions provided on page two of the form.

Where do I send Form CT-W4?

Form CT-W4 is sent to the employer. An employee should keep a copy for her records. The employer should file the form and its copies with Department of Revenue Services.